Private rented sector sentiment survey results

mydeposits and Ome release private rented sector sentiment survey: results from 14,200 landlords, agents, and tenants:

mydeposits and our partners, deposit replacement membership scheme, Ome, joined forces at the end of 2020 to launch our first joint sentiment survey. The first of its kind, the aim of the survey was to gather information and opinions from a broad cross-section of tenants, agents and landlords and to compare their views on the sector.

Assessing the views of landlords, agents and tenants in this way gives a holistic and well-rounded view of the private rented sector. The insight gained will prove useful in aiding identification of trends, common themes and potential issues, leading to the overall improvement of the sector.

This extensive survey opened in December 2020 and received a total of over 14,200 responses from tenants (79%), landlords (19%) and agents (two per cent) throughout the UK.

Demographics:

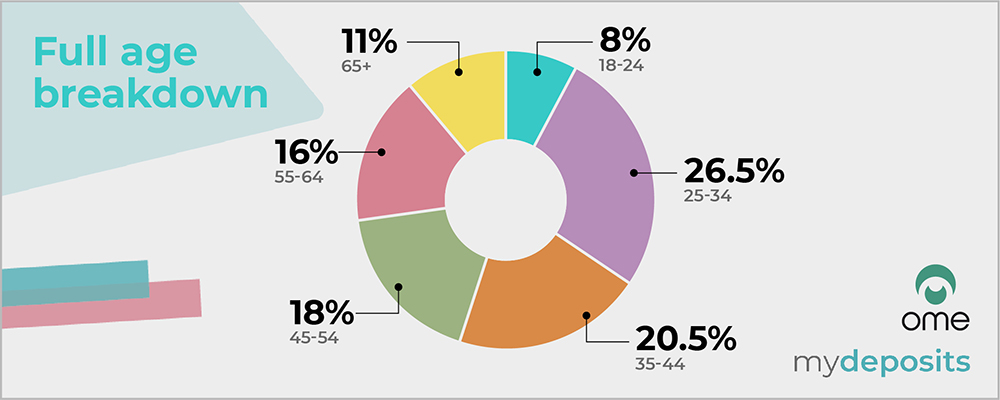

The survey received responses from people across a wide age range. The most common age bracket for participants was 25-34, making up over a quarter (26.3%) of responses.

It is possible to infer that more people from this age bracket took part in the survey due to the number of this age range renting. In recent years rising house prices and inflation has made it more difficult for younger adults to purchase homes, leading millennials to be known as ‘generation rent.’

For more information on ‘generation rent’ check out the Hamilton Fraser guide ‘Generation Perma-rent: Who are they and what do they want from landlords’

The full age breakdown:

- 18-24 (8.17%)

- 25-34 (26.3%)

- 35-44 (20.5%)

- 45-55 (17.96%)

- 55-64 (15.93%)

- 65 and over (11.08%)

Survey respondents, whether agents, landlords or tenants, were mainly from London and the South East. Over a quarter of the agents that took part in the survey were based in Greater London (26.85%), with 17.59% operating in the South East. Similarly, just under a quarter (24.94%) of landlords who took part in the survey were based in Greater London and another quarter (24.45%) in the South East. Again, around a quarter (26.93%) of tenants were renting in Greater London and 18.88% in the South East.

It is well known that house prices in London are far higher than in the rest of the country and this could explain the increased numbers renting in the capital – despite rents also being high.

Agent demographics:

Survey results showed that almost 80% of agents were from small agencies with one branch or office (78.7%) and 14.35% of agents reported having two to five branches. 4.17% of agents had over 21 branches to their agency and the least common demographic was agents with 11-20 branches, making up just 0.46%.

Over eight in ten agencies (81.94%) had less than ten employees, 6.48% had 11-20, 4.17% had 21-50, 3.7% had 51-100 and 3.7% had over 101 employees.

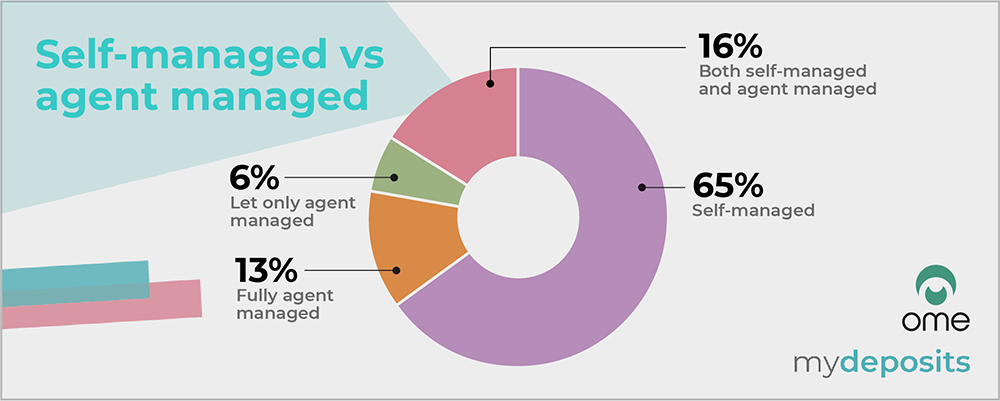

Landlord demographics:

Most landlords who took part in the survey had a small portfolio letting two to five properties (42.55%).

Landlords renting one property were the second biggest contingent making up 28.28%. 14.5% of landlords let out six to ten properties, 8.58% let out 11 to 20, and only six per cent of landlords had over 21 properties (6.09%).

Almost half of the landlords surveyed became landlords through buy-to-let (43.44%), 17.03% due to pension investment and of the 15.07% who selected ‘other’ over a quarter (26.3%) were renting out properties that they had lived in or planned to live in soon.

Over ten per cent (11.2%) reported being a landlord for business reasons and another 10.02% saw their portfolio as an investment.

Most landlords surveyed were self-managed, with two-thirds (64.96%) managing their own portfolio, 12.85% of landlords used full management via an agent and 16.41% were both self-managed and agent-managed. When questioned, 31.32% of landlords were very confident with their choice of property management.

For advice on choosing a letting agent check out the Hamilton Fraser Guide ‘The ultimate landlord guide to choosing a letting agent’

When asked what type of tenants they let to, the most common response from landlords was professionals (39.2%), followed by families (28.2%).

- – Professionals (39.2%)

- – Families (28.8%)

- – Tenants on Universal Credit (9.19%)

- – Students (7%)

- – Other (6.21%)

most commonly:

- – Working people (21.43%)

- – Retired people (19.74%)

- – Commercial lets (6.72%)

- – Any, no preference (4.72%)

- – International students (4.3%)

- – Ex-offenders (0.6%)

Sometimes landlords struggle with the decision of who to let their properties to. Check out Hamilton Fraser’s advice on ‘How to attract and retain your ideal tenants’, or if you’re thinking of diversifying your portfolio and renting to students, check out: ‘Renting to student tenants – what landlords need to know’.

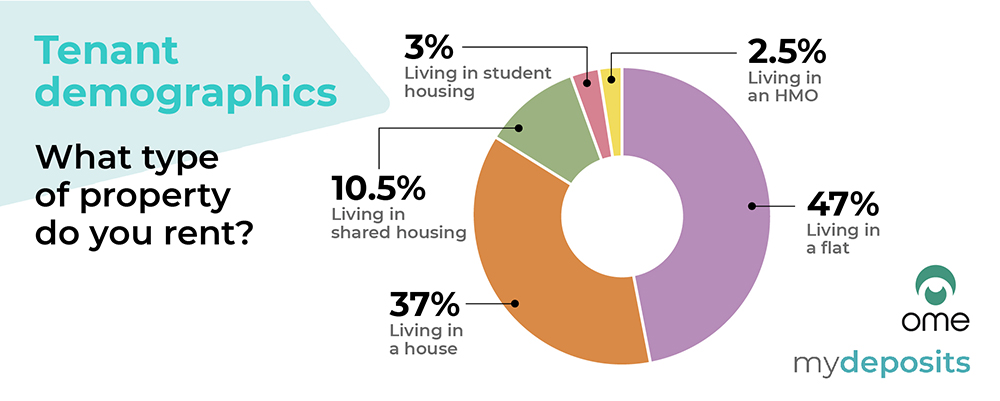

Tenant demographics:

Over half of the tenants who took part in this survey were settled in their current homes (59.64%), 11.4% were looking to buy their first homes, and 10.38% were preparing to search for their next rented homes.

- 47.03% reported living in a flat

- 37.12% in a house

- 10.31% of tenants were in shared housing

- 3.13% of tenants were in student housing

- 2.31% in an HMO

Over two thirds of tenants surveyed (67.3%) had long-term aspirations to buy their own home, while 13.7% of respondents were happy to continue renting.

Of those surveyed, most tenants had only lived in one other rental property in the last five years (28.74%), just over a quarter had lived in between three and five (25.29%) and only 3.28% had lived in more than five properties in as many years.

Tenants cited work commitments as the most common reason for frequent relocation (24.7%), 14.1% had moved around as a student, and 8.1% had moved when their landlord sold the property.

Most tenants did not have a pet (76.83%), but of the 23.17% who did, almost half (43.6%) said they had difficulty finding properties that allowed them. A further 8.5% of tenants reported having to pay an additional deposit or increased rent to keep a pet.

The debate surrounding allowing pets in rented homes is a hot topic within the private rented sector at the moment. Find out more in LandlordZONE’s article entitled ‘Should landlords be worried by the pet changes in the latest Model Tenancy Agreement?’

The relationship between landlords, agents, and tenants:

Despite the often-frosty relationship portrayed in the media between landlords and their tenants, survey responses painted a more positive picture, with tenants rating their relationship with their landlord on average 7.4 out of 10. An approval rating of over 70%.

Similarly, agents and landlords were overwhelmingly positive about their relationship with their tenants, 30% rated the relationship a nine out of ten. 29% rated their relationship ten out of ten, with over 88% of respondents choosing seven and above.

For advice on how to cultivate a good relationship with your landlord, check out the Ome guide ‘How to build a positive relationship with your landlord.’

Government support:

Unfortunately, the devastating impact of the COVID-19 crisis ensuing lockdowns, recessions and redundancies have led to increased need for government support and financial assistance.

In November, the Office for National Statistics reported that the unemployment rate from September to November 2020 was at five per cent. The BBC reporting predicted rises in unemployment to 7.5% or 2.6 million people by mid-2021.

When asked whether they felt supported by the Government as a tenant, over half felt either not very supported or not supported at all (50.17%).

However, of those who felt supported, 41% pointed to support through legislation such as the Tenant Fees Act, Fitness for Human Habitation Act and deposit protection legislation. And, over a third (39%) highlighted financial help from the Government, such as the furlough scheme, student finance allowances, council tax discounts, housing benefits and universal credit. Over 12% also felt supported by the Government’s eviction extension ban during the pandemic.

Almost one in three (27.9%) tenants did not feel supported by the Government at all or were unaware of any support. Over a fifth (20.2%) said there was not enough legislation or protection for tenants and almost 15% (14.4%) felt that the Government was in favour of landlords rather than tenants.

In addition to comments made by tenants, almost 90% of landlords and agents said that they did not feel that the private rented sector was supported by the Government. Over a quarter of agent and landlord respondents (26.6%) said that there was a lack of support because the Government was anti-landlord or pro-tenant, and another 22% pointed to increased regulation, legislation, and taxation.

Despite landlords, agents and tenants all individually stating they felt unsupported by the Government this feeling is not unique to one specific demographic and therefore opens up further questions about why landlords, agents and tenants believe they are receiving an unfair deal.

However, when landlords and agents were asked about the most common challenges faced, 76% identified this as legislation. Second was rent, with almost one in five agents and landlords (19.66%) highlighting it as a common challenge faced.

Of the 12.91% who selected ‘other’ the most commonly specified reasons were:

- Tax (32.8%)

- Lack of government support (14.4%)

- Impact of COVID-19 (11.4%)

Opinions on value for money:

Perhaps unsurprisingly tenants’ opinions diverged from landlords and agents when it came to the issue of whether renting was good value for money.

Almost half of tenants (49%) said that they did not feel that renting offered good value for money, with 37% saying if they could afford to, they would purchase a property themselves.

When asked why they felt renting did not offer good value for money, almost a quarter (24%) of tenants said renting was too expensive, almost 15% said it was more expensive than a mortgage, and 11% said that renting was their only option because they could not afford the initial deposit required to purchase a property.

Contrastingly, when the same question was posed to landlords and agents, over three quarters said that they believed that renting does offer good value for money (76.39%), attributed to the flexibility it affords renters (13%) and advantage of being absolved of maintenance costs and worries (9.4%).

However, interestingly around a quarter of landlords and agents did admit that they do not believe that renting offers good value for money (24%), with 12% of agents and landlords stating that renting is far too expensive.

This theme of unaffordability is corroborated by results from the Office for National Statistics (ONS) which found in December 2020 that the median monthly rent in England between October 2019 and September 2020 was the highest ever recorded at £725.

Rent arrears:

Rent arrears have been a cause for concern for many landlords and agents, especially due to the COVID-19 pandemic. Most tenants surveyed pay between £501 and £700 rent per month (28.62%) with 21.51% paying between £702 and £900 and less than one in five paying over £1,201.

Despite the industry perception surrounding large-scale rent arrears as a result of COVID-19, most tenants (95%) reported that they are not in rent arrears as a result of the crisis. However, this answer was not shared by landlords and agents, with over four times as many saying that their tenants were currently in rent arrears due to the consequences of the pandemic (31%).

This difference perhaps highlights a lack of awareness from tenants who are in rent arrears, and/or a lack of communication between all parties regarding rent payments and arrears. Similarly, tenants may also be in arrears for reasons that are unrelated to COVID-19.

In the cases where there were rent arrears, a quarter of agents and landlords surveyed claim to have accommodated their tenants’ needs by formulating a payment plan (25%). In addition, 18.4% provided rent reductions and almost 17% offered a rent payment extension or holiday.

Almost one in six tenants surveyed confirmed that their landlord had been accommodating to their struggles in paying rent (57.99%). And around a third (31.1%) had been offered reduced rent or a rental holiday by their landlord.

Of the 43.01% of tenants who stated that their landlord had not been accommodating during their financial troubles brought on by the COVID-19 crisis, almost half (45.9%) said they had received no help or support and 29.6% had been made to pay full rent or clear arrears after losing their job.

For more advice on rent arrears as a result of the coronavirus crisis, check out the Hamilton Fraser guide ‘Landlord advice: A tenant repayment plan in the fallout of COVID-19.’

Traditional tenancy deposits:

Unsurprisingly, in line with government legislation on deposit protection, the vast majority of landlords and agents take tenancy deposits (92.07%), while almost eight per cent (7.93%) admitted they do not.

Of those who take a deposit, over 40% take a deposit equal to five weeks’ rent as also supported by tenants (40.75%). However, of the one in five tenants who selected other (19.03%), 44.8% reported this was equal to six weeks’ rent.

The Tenant Fees Act came into force in June 2019 to ban fees paid by tenants in the private rented sector and capping tenancy deposits in England. The act came into force three years ago and means that a refundable tenancy deposit is capped at no more than five weeks’ rent where the annual rent is less than £50,000, or six weeks’ rent where the total annual rent is £50,000 or above.

For more information, check out the Hamilton Fraser Guide ‘The tenant fees ban – what do you need to know?’ or download the Tenant Fees Act 2019: Guidance for landlords and agents.

Deposit replacements:

Deposit replacement schemes are a fairly new innovation, brought to market recently to offer an alternative to the traditional tenancy deposit. There are a multitude of options for deposit-free renting now, including offerings from agents and from independent schemes, such as Ome.

There are obvious benefits to deposit replacement schemes. They can be time-saving by reducing the burden of time and energy that often goes into protecting cash deposits and also reduce the legislative risks associated with protecting deposits.

Deposit replacements offer the option of deposit-free renting which can aid cashflow for prospective tenants and most importantly, they provide tenants, agents and landlords with choice when it comes to their deposit options.

Of the over 14,000 tenants, agents and landlords who responded to this survey, only six per cent had previously used a deposit replacement.

Of those who had used a deposit replacement almost a quarter opted for this over a traditional deposit protection scheme to make it more affordable for their tenants, and 15% chose a deposit replacement because it was advised or offered by an agent.

When asked, 31% of all agents, landlords and tenants would consider using a deposit replacement scheme in the future.

Almost 50% of landlords claimed that although they were unwilling to commit to a deposit replacement at the moment, this was primarily because they did not know enough about the products or how they work.

This is unsurprising as deposit replacements are relatively new within the private rented sector and highlights the need for further education when it comes to these deposit options. 19% said they would not consider a deposit replacement option, with six per cent stating they are happy to stick to traditional deposit protection as they feel it works well for them.

This supports Ome’s philosophy that deposit replacements are about choice and flexibility, they may not be for everyone but their introduction to the market provides additional cash flow support which can be of benefit to a number of tenants.

Understanding both how traditional deposit protection, and deposit replacements work, is key for selecting the deposit solution that is right for you as a tenant, landlord or agent. For more information on how deposit replacement schemes work, Ome has put together a guide to explain everything you need to know.

Results showed an unease surrounding deposit replacement schemes, as they were ranked the least trustworthy, on average at 2.81 out of six. This however is not unsurprising when we consider recent media coverage surrounding do-it-yourself deposit replacements that are being offered by some agents in the market. These alternatives carry some additional risks that are not found in independent membership schemes, such as Ome.

Read more about ‘the risks of ‘do-it-yourself’ deposit replacement schemes’.

Despite this, deposit replacements were only rated as 0.01% less trustworthy than traditional insurance deposit schemes, which scored just 2.82 on average. Custodial schemes were seen as twice as trustworthy as both, rated 4.79. Trust and transparency therefore appear to be core elements that are sought after from tenancy deposit solutions, traditional or alternative, as well as a greater understanding of their benefits and drawbacks for tenants, landlords and agents.

How has the market changed?

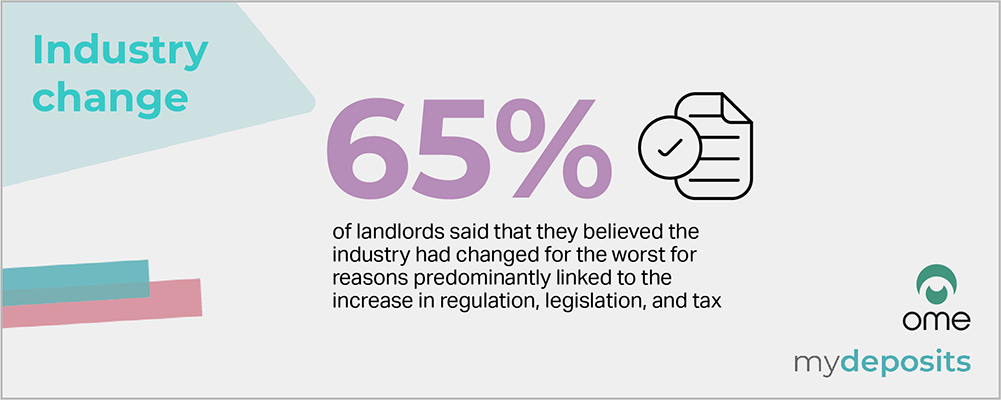

The private rented sector has seen significant changes over the last few years, especially in relation to legislation, regulation and most recently the COVID-19 pandemic. Some interesting insight gained from landlords and agents found:

- 65% of landlords said that they believed the industry had changed for the worst for reasons predominantly linked to the increase in regulation, legislation, and tax

- 79%t still believed they would be a landlord in five years’ time

- 31% would continue to rent as it provided a source of income, or was an investment

- 18% of landlords rented their properties to fund their retirement or as a pension

- Landlords and agents gave their current experience working in the rental market seven out of ten

Therefore, it can be deduced that although being a landlord may be perceived as becoming more onerous due to legislation, regulation and tax changes, it is still a profitable and worthwhile endeavour for many.

Tenants contrastingly were less likely to report any of their experiences having changed during their time within the private rented sector, with 24% reporting no change. However, almost 13% did report having a more negative outlook on the sector, most commonly attributed to the ever-rising costs associated with renting (11.71%). Once again reiterates a common theme of lack of affordability and value for money felt by tenants in the sector.

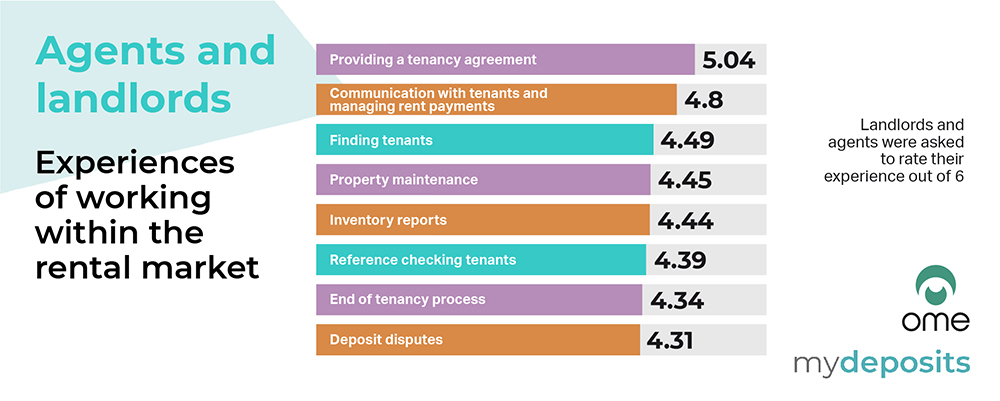

Ranking rental experiences:

There are several rental activities associated with being a good landlord or agent. Agents and landlords were asked to rate their experiences of working within the rental market in several areas (out of six).

- Providing a tenancy agreement (5.04/6)

- Communication with tenants and managing rent payments (4.8/6)

- Finding tenants (4.49/6)

- Property maintenance (4.45/6)

- Inventory reports (4.44/6)

- Reference checking tenants (4.39/6)

- End of tenancy process (4.34/6)

- Deposit disputes (4.31/6)

Interestingly the results here were very close, with only 0.73 between the best and worst-ranked area. Also, all eight areas were rated above average which demonstrates the overwhelmingly positive nature of rental experiences for landlords and agents.

For help and advice on improving your ratings in these areas check out the following Hamilton Fraser resources: End of tenancy cleaning and inventory checklist , How to create a legal and binding tenancy agreement , Property maintenance tips for all seasons , How to manage property maintenance during the COVID-19 crisis and How to manage your inventory.

‘Worst things facing the private rented sector?’

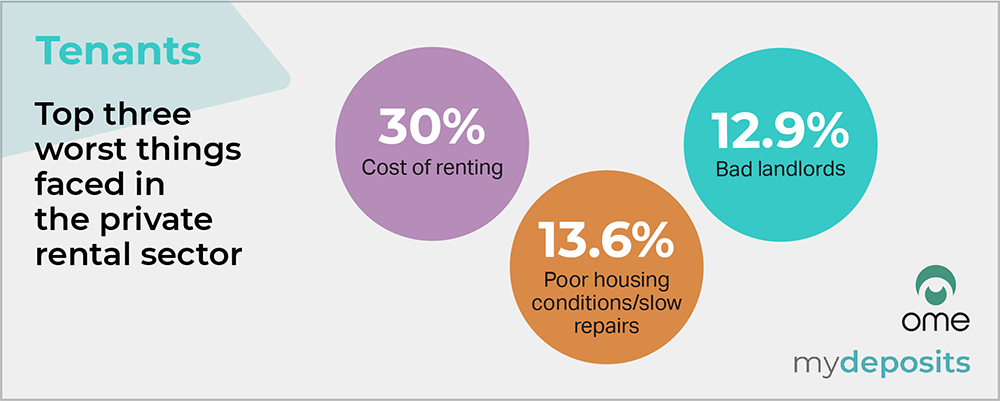

As discussed, changes in the private rented sector have been profound over the last few years. Tenants, landlords and agents were asked to identify the worst thing they faced within the sector, with interesting, but maybe unsurprising responses when we consider the consistent themes already seen throughout the survey.

Tenants commented that the three worst things they faced in the current rental market were:

1. Cost of renting (30%)

2. Poor housing conditions / slow repairs (13.6%)

3. Bad landlords (12.9%)

Although cost was identified as the worst thing facing tenants it was also listed as the most common reason why tenants chose to rent, this included:

- Cost or affordability (51.24%)

- Flexibility of renting (28.25%)

- Other reasons (23.5%), included inability to afford their own home (52.4%), 12.8% had no choice but to rent, and 7.8% were students

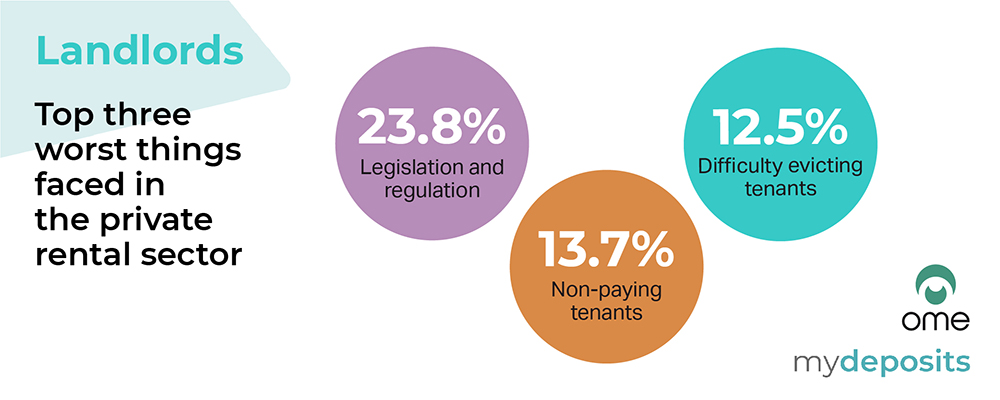

Landlords commented that the three worst things they faced were:

1. Legislation and regulation (23.8%)

2. Non-paying tenants (13.66%)

3. Difficulty evicting tenants (12.49%)

Rent arrears or non-paying tenants was the second most common response, with almost 14% citing these as challenges. The most common grievance facing landlords was legislation/ regulations (14%), and the third most common response was difficulty evicting tenants (12%).

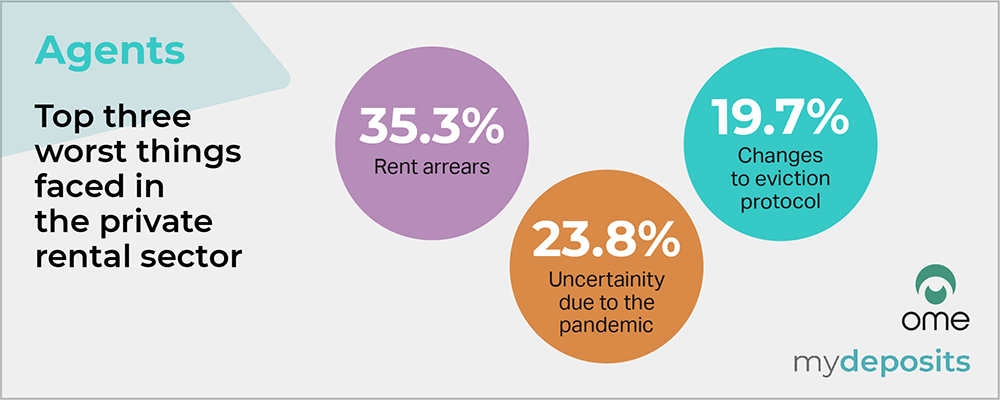

Interestingly, when agents were asked: ‘What are the three worst things agents face in the current rental market?’ the most popular response was rent arrears, with 35% of agents stating that as the biggest challenge.

According to agents, the biggest issues facing them were:

1. Rent arrears (35.3%)

2. Uncertainty due to the pandemic (23.8%)

3. Changes to eviction protocol (19.7%)

Whilst landlords, agents and tenants understandably identified different stumbling blocks in their rental experience, when considered together the results paint a clearer picture. It could be suggested that the high costs and affordability issues felt by tenants manifest as rent arrears for agents and landlords, making the problem cyclical. Greater awareness and communication between all parties could therefore be extremely important in maintaining good landlord/agent/tenant relationships, preventing issues from occurring in the first place, or providing workable solutions for all parties.

For advice and insight on how important effective communication is for landlords to attract and retain tenants, check out the Hamilton Fraser guide ‘Communication is the answer.’

Technology:

The emergence of PropTech has accelerated in the past few years and has been exacerbated by the current pandemic, leading to new experiences for many tenants, including virtual viewings.

A significant proportion of respondents felt that technology within the market was equal to everyday life (39.64%), however of those who felt it was behind everyday life (33.42%), 23.3% were unaware of the technology available or saw it as too scarce. A further 16.3% saw rental market technology as out of date or old-fashioned.

Of those who believe rental market technology is ahead of technology in everyday life (6.29%), a quarter (24.8%) pointed to the introduction of virtual tours or video viewings.

Is the private rented sector fit for purpose?

Overall, the majority (54.79%) of landlords, agents and tenants did see the rental sector as fit for purpose, with just less than half (45.21%) disagreeing.

Of those who saw the sector as fit for purpose:

- 32.7% reported good experiences and no issues whilst renting

- 28.5% saw it as working for them

- 9.8% thought it worked well and suited the needs of all parties involved

- 7.9% said it was the only choice for those who cannot afford to buy

7.4% believed that the majority of landlords are good and look after their tenants and properties

Of those who saw the sector as not fit for purpose:

- 31.9% said this was because it is unaffordable

- 9.7% said the private rented sector needs more regulation

- 7.6% pointed to current and previous experiences with rogue landlords

- 4.8% highlighted lack of government support to protect tenants

It is interesting that affordability is again the most popular response from tenants when examining challenges facing the rental market.

Communication preferences:

The question of preferred communication was posed to all tenants, landlords and agents with 65.76% preferring online communication (email, text messaging) and a third (34.24%) favouring face-to-face communication or phone calls.

With this in mind, agents and landlords may want to enquire about tenants’ preferred contact methods to get their communication off to a good start. For more advice and tips on how to welcome new tenants, check out the Hamilton Fraser guide ‘How to create the perfect welcome pack for new tenants.’

Key survey conclusions:

The first joint sentiment survey from mydeposits and Ome has been hugely successful in gathering a wide range of both qualitative and quantitative data from diverse groups of tenants, landlords and agents throughout the UK.

It has surpassed all expectations by reaching over 14,200 people from all corners of the country and giving them a voice to confidentially express their opinions on the private rented sector.

It is hoped that the findings of this survey will be instrumental in improving the private rented sector for all involved. Key themes that emerged throughout the survey included rental affordability, regulation and rent arrears. Communication, increased trust and transparency between landlords, agents and tenants also appear to be areas in which further focus could help to have a positive impact on reducing some of the challenges faced by all parties. Despite this, landlords, agents, and tenants, for the most part, do see their relationships in a positive light and paint a largely favourable view of the private rented sector, both now and in the future.

With increased regulation, legislation changes and the continued uncertainty of the COVID-19 pandemic, future sentiment surveys will be invaluable to further compare and contrast these findings and track the changing nature of the private rented sector.