Paying interest on deposits

If your deposit is held with us in our Custodial deposit protection scheme, you will earn interest on it from the day your deposit is protected. This means that at the end of your tenancy you might receive interest in addition to getting your deposit back.

What does this mean for you?

- Once your deposit has been protected with mydeposits you will start to earn interest on it

- The interest you earn will be calculated daily based on the current mydeposits interest rate of 1.19%. We review this rate on a monthly basis

- Any interest you have earned at the end of the tenancy will become available when your deposit balance is £0

- If your landlord chooses to transfer your deposit to a different deposit protection provider, we’ll transfer any interest along with your deposit. Please note, you will need to claim this back from the new deposit provider at the end of your tenancy

- Payment of interest will be made within 10 working days of the tenant contacting us about interest post release

- Payment of interest will only be entitled by BACs, we will not send any interest by cheque

- Interest will only be calculated and accrued from 1 July 2023 onwards

Donating your interest to charity

If you would prefer, you have the option to donate the interest earned to our chosen charity, Centrepoint, instead of claiming it yourself.

You can let us know if you choose to donate your interest to the UK’s leading youth homelessness charity, Centrepoint, at any point during your tenancy or at the end of tenancy, on your online account. At mydeposits, we have chosen Centrepoint as our charity of choice and are working alongside them to support their campaign to end youth homelessness by 2037.

Frequently asked questions

- email info@mydeposits.co.uk or contact us via live chat confirming:

- DPC

- vacating tenant

- replacing tenant

- who the lead tenant is if the lead tenant has vacated

- deposit ID (starting EWC)

- vacating tenant

- replacing tenant

- replacing tenant contact details including email address & mobile number

- who the lead tenant is if the lead tenant has vacated

- deposit ID (starting EWC)

- vacating tenant

When can we action this?

We can action this at any time while the deposit status remains protected and there is more than one tenant on the protection. When can’t we action this? If the tenancy is a sole tenancy, this would require a deposit release.Adding a tenant:

Insured: How to action this?- Email info@mydeposits.co.uk or contact us via live chat confirming:

- DPC

- additional tenant name

- deposit ID (starting EWC)

- additional tenant

- additional tenant contact details including email address and mobile number

- being unable to recover possession of the property using a Section 21 notice

- being required to lodge the deposit with a custodial scheme or return the deposit to the tenant within 14 days

- paying the tenant between one and three times the deposit amount in compensation as well as refunding the full deposit

| Deposit protection | Standard pay as you go fee | Discounted fee for NRLA members |

|---|---|---|

| Up to £500 | £20 | £13.20 |

| Over £500 | £27.20 | £17.95 |

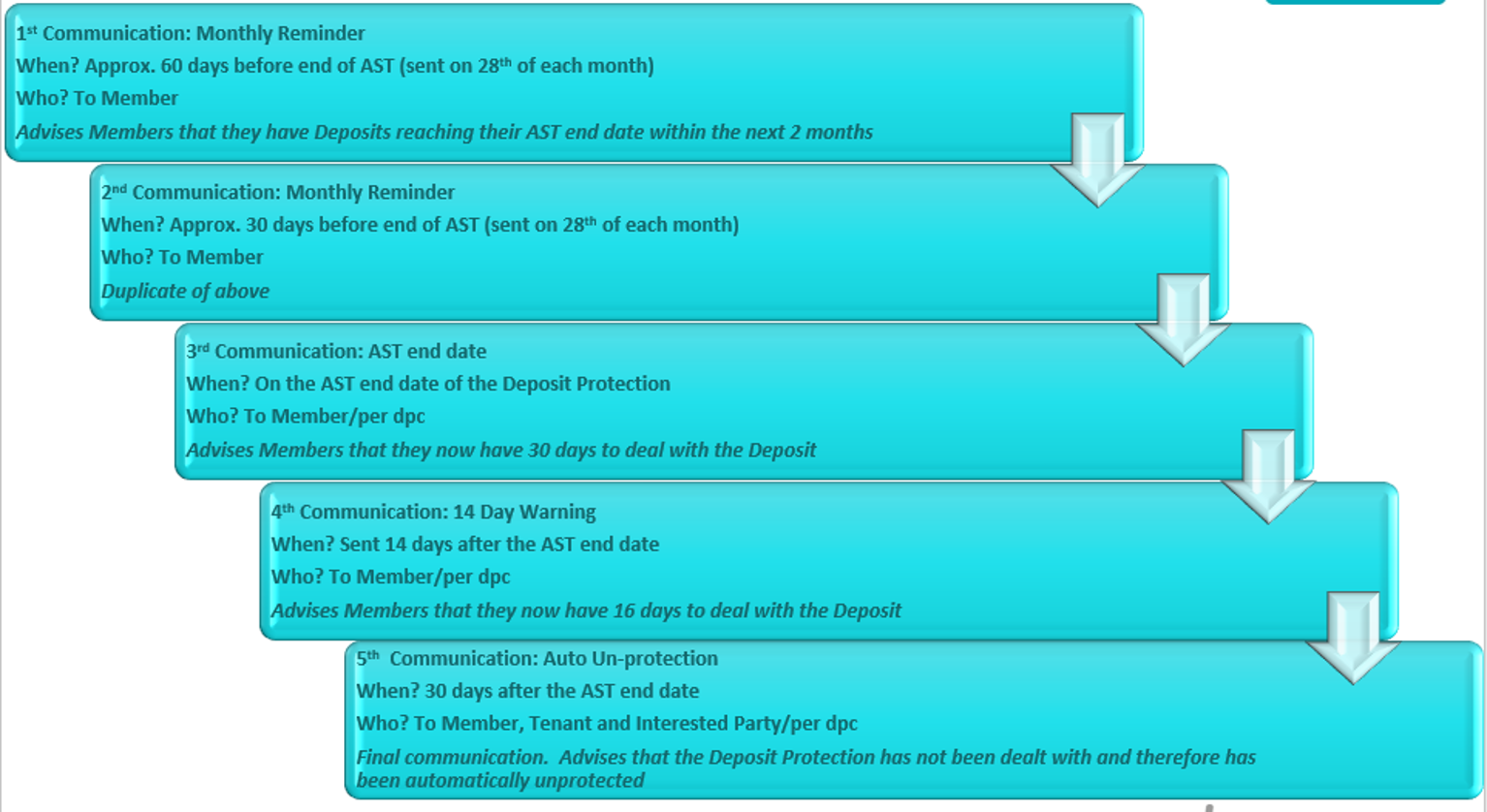

- the tenancy has ended and the deposit needs to be unprotected

- the tenancy is extending into a periodic tenancy, whether contractual or statutory

- the tenancy has been renewed with a new fixed term

If the deposit is automatically unprotected you can contact us within 30 days of the automatic unprotection and pay to reinstate the deposit protection at the original protection fee. You will not have to reserve the prescribed information as former protection will be reinstated. If you contact us outside the 30 day period, you will need to purchase a new deposit protection and re-issue new prescribed information.

If the deposit is automatically unprotected you can contact us within 30 days of the automatic unprotection and pay to reinstate the deposit protection at the original protection fee. You will not have to reserve the prescribed information as former protection will be reinstated. If you contact us outside the 30 day period, you will need to purchase a new deposit protection and re-issue new prescribed information.- Where annual rent is £50,000 or below, a maximum of 5 weeks’ rent can be taken.

- Where annual rent is £50,001 or above, a maximum of 6 weeks’ rent can be taken.